The case for alternative and innovative assets

Trends that are reshaping asset allocation

From artificial intelligence to blockchain, from robo-advisors and algorithms to full asset management automation - the world is moving forward exponentially, and the waves of disruption are fundamentally changing the financial industry. But all the news about FinTech challenging the business of incumbent banks too often misses a crucial point: not only the involved players and ways of doing business are under constant change, but also the nature of the underlying assets and allocations in investment portfolios.The spotlight is shifting more and more to alternative assets, which have reached a global market capitalization of $10.3 trillion in 2020 (not including digital assets) [1]. While this is still a fraction of the overall financial markets – both global equity and bond market capitalizations top $100 trillion – the growth rate in this niche is outpacing the rest. In the last 15 years, the share of alternative investments in the global financial markets has increased from 6% to 12%. By 2025, it is expected that the alternative asset class will reach a market share of 18% to 24% [2].

This growth is majorly attributed to two notable paradigm shifts in the financial industry.

First, alternative investments are becoming more accessible. The democratization of traditional financial services has not stopped at the reduction of barriers to stock trading by innovators like Robinhood but moved beyond it improving access to alternative assets. Today it's easier than ever for individuals to invest in alternative assets, thanks to innovations like Digital Waves' services that make them bankable in the first place.

The second paradigm shift concerns the search by investors for investment opportunities that offer attractive returns in a low-to-negative interest rate environment and that have little or no correlation to the general market environment to hedge their portfolio risks in volatile times. Therefore, in this article, we will take a closer look at alternative assets, their common characteristics, and why they are a good addition to any portfolio.

What are alternative and innovative assets?

There is no single definition of alternative assets. They are therefore best described as what they are not. Stocks, bonds, ETFs, FX, and cash-related holdings are traditional assets. Simply said, everything besides these traditional assets may be defined as an alternative investment which can include commodities, private equity, collectibles, real estate, or hedge funds, to name a few.

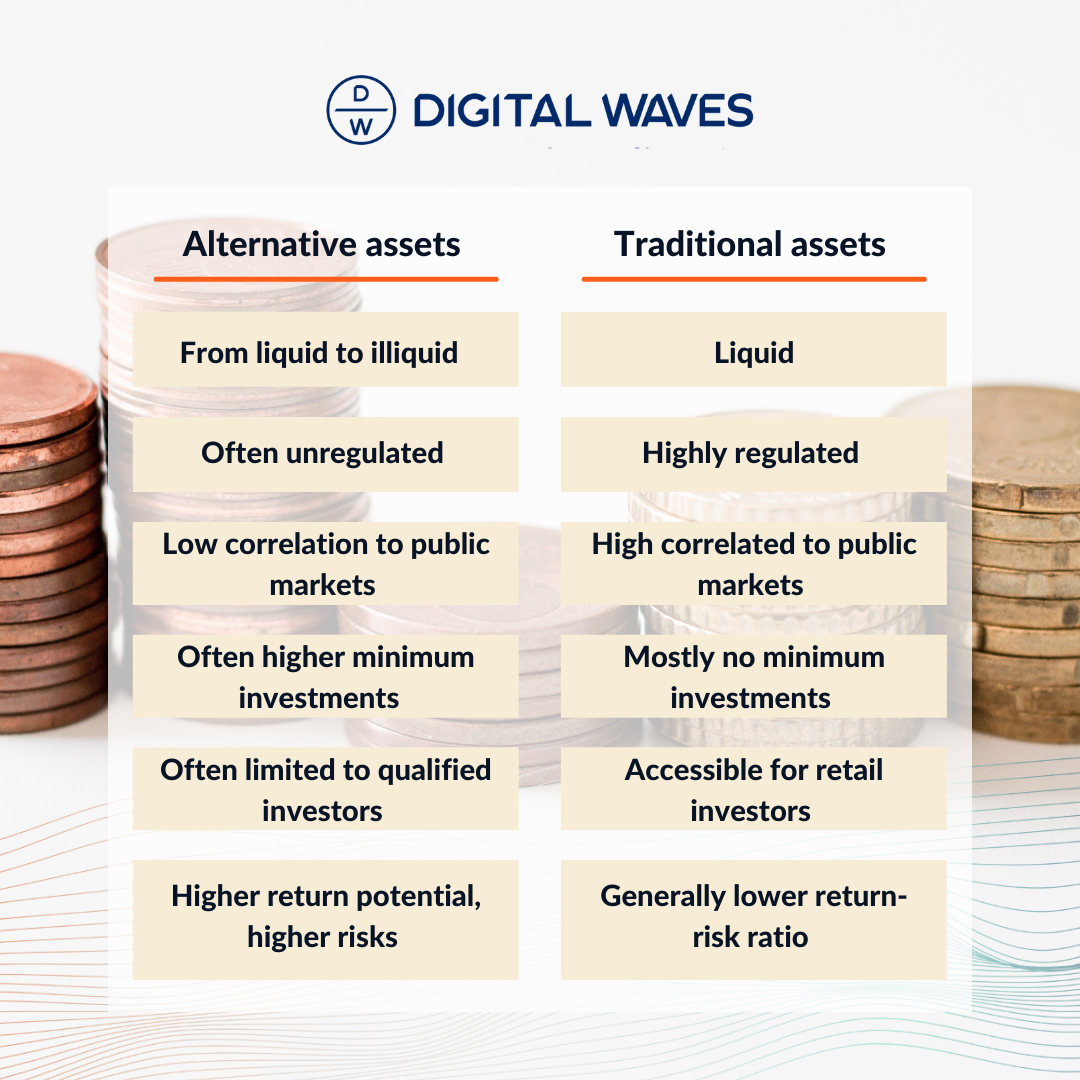

Taking a closer look at traditional and alternative assets, we can generally distinguish key characteristic differences. Alternative investments typically promise higher returns than traditional investments but also involve higher risks. They are generally less accessible and sometimes illiquid. Venture capital is a perfect example. Investing in the next generation of tech start-ups is usually reserved for a few investors due to high barriers to entry, e.g., in the form of high minimum ticket sizes. Investors also usually must tie their capital in closed-end funds for multiple years - with only a few exceptions. Such investments need a comprehensive understanding of the topic, as information on start-ups is by nature more limited than on public companies. In contrast, traditional investments are considered liquid as they can be bought and sold relatively easily on the open market, which is not possible with pre-IPO companies.

The table below compares the most common but schematic characteristics of traditional and alternative investments - subject to constant variability.

|

||

| Table 1: The most common characteristics of traditional and alternative investments. |

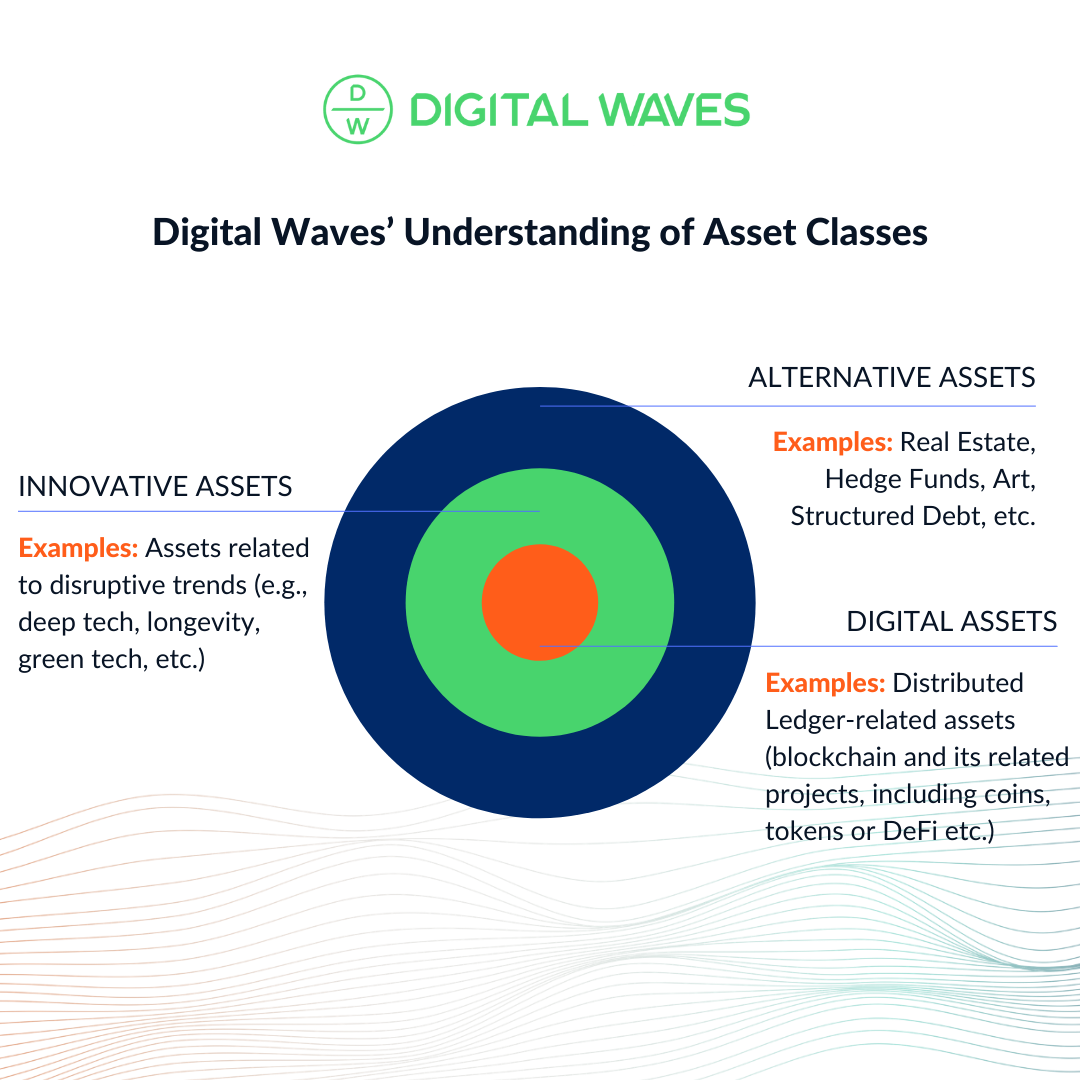

While all different kinds of alternative assets provide a way to diversify investment portfolios, this blogpost of Digital Waves mainly focuses on two sub-tiers of alternative assets: innovative & digital assets. Assets of innovation refer to alternative assets that have growth or scalability potential due to their innovative or tech-related nature, including, for example, equity in disruptive tech start-ups, green tech, or longevity projects. Digital assets, on the other hand, are the core of Digital Waves’ service offering and refer to Layer 1 and 2 blockchain projects, their coins and tokens (such as Bitcoin and other cryptocurrencies), DeFi applications, or NFT.

|

||

| Graph 1: Digital Waves' understanding of asset classes. |

What is the role of alternative assets in an investment portfolio?

Alternative assets offer investors a way for diversifying their portfolio and making it resilient in the face of global and economic disruptions. Blackrock reports that even pension funds, known for their conservative investment strategies, are increasingly allocating funds towards non-traditional asset classes for this reason. While in 1996, they represented only 5% of the global pension portfolio, the proportion increased steadily and went up to 26% percent over 20 years later.

The integration of alternative investments not only leads to a better risk balance in portfolios but mostly also to higher returns. The Yale Endowment Fund, for example, saw annual returns between 3.4% and 12.3% between 2016 and 2021 - with the venture capital position within the portfolio generating the highest returns (between 16.2% and 23.5%), making it the most significant contributor to the funds' performance. [3]

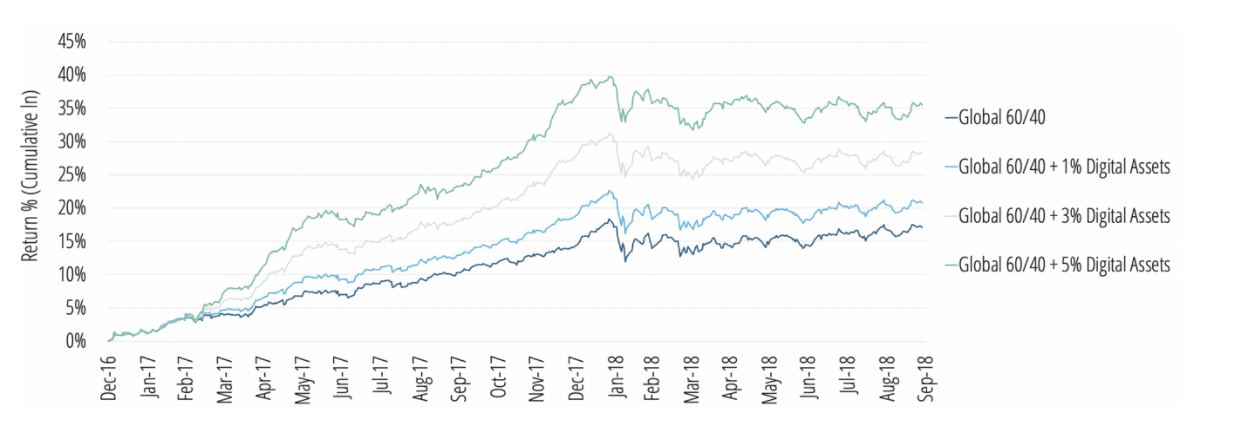

Recent research shows that adding 2.5% allocation in digital assets such as cryptocurrencies to a traditional 60/40 quarterly rebalanced portfolio increases the median three-year cumulative return by 13.3%. Other studies have come to similar conclusions. Adding between 1% and 5% of digital assets to a portfolio of 60% global equity and 40% global bond investments (Global 60/40) has improved the performance on an absolute and risk-adjusted basis. [4,5]

|

||

| Graph 2: Hypothetical Simulated Portfolio Performance – 31 December 2016 to 30 September 2018 [4]. |

And in our opinion, that is just the beginning. Exposure to digital assets, for example, is still in its infancy and primarily happens through investments in Bitcoin or other cryptocurrencies. In 2021 major cryptocurrencies take up to 80% of the whole market of digital assets, leaving the rest to the new areas, such as DeFi or NFT and associated investment products, which promise returns that are still largely untapped [6]. Offering the gateway to the unexplored kinds of innovative assets are at the core of Digital Waves’ mindset and service offering.

What is an optimal allocation of alternative assets in a portfolio?

Investment portfolios traditionally consist of 60% stocks and 40% bonds. There is no universal answer to the question in what proportion alternative should be held in a portfolio. The allocation of alternative and especially digital assets in a portfolio depends on the investor's risk appetite and goals. Three scenarios are conceivable:

- Goal Option 1 – Capital Protection: 10% to 20% of the portfolio's value in alternative assets, including 1% to 2% in digital assets.

- Goal Option 2 – Capital Appreciation: 20% to 40% of the portfolio's value in alternative assets, including 5% to 8% in digital assets.

- Goal Option 3 – Active Income Generation through alternative investments: 40% to 60% of the portfolio's value in alternative assets, including 10% to 20% in digital assets.

If you decide to add alternative or even digital assets to your portfolio, there are two very general ways of investing in alternative assets. Direct investing allows investors to allocate their capital into the assets themselves. On the contrary, indirect investing is the approach in which investors normally go through an intermediary, by selecting suitable investment products, opening dedicated managed accounts, or an investment setup which ‘pool’ the capital of many investors and invests and manages assets according to a certain strategy. Digital Waves as a financial intermediary may help you implement the right alternative investment strategies.

Digital Waves provides clients with a gateway to investing in the future economy. It is done by securitizing assets from equity of disruptive start-ups to the latest crypto token through actively managed certificates (AMC) and by providing opportunities to directly gain exposure to digital assets.

The SVBS1 - Disruptive Tech Portfolio makes 20+ disruptive companies from various industries and markets investible through an Actively Managed Certificate (AMC). All start-up companies use deep-tech such as Artificial Intelligence (AI), Internet of Things (IoT), and Blockchain.

The SVBS1 is structured as an open-ended investment product that is easily accessible via a Swiss ISIN through a bank transaction and has no capital calls, lock-up, or holding period.

***

Would you like to become part of the Digital Waves & SVBS portfolio of the next generation of tech innovators?

Discover more here.

Contact us.